Are Water Bills Tax Deductible . you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. The following utilities related to your property. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. you can claim a tax deduction for the portion of utilities related to your rental property or suite. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year.

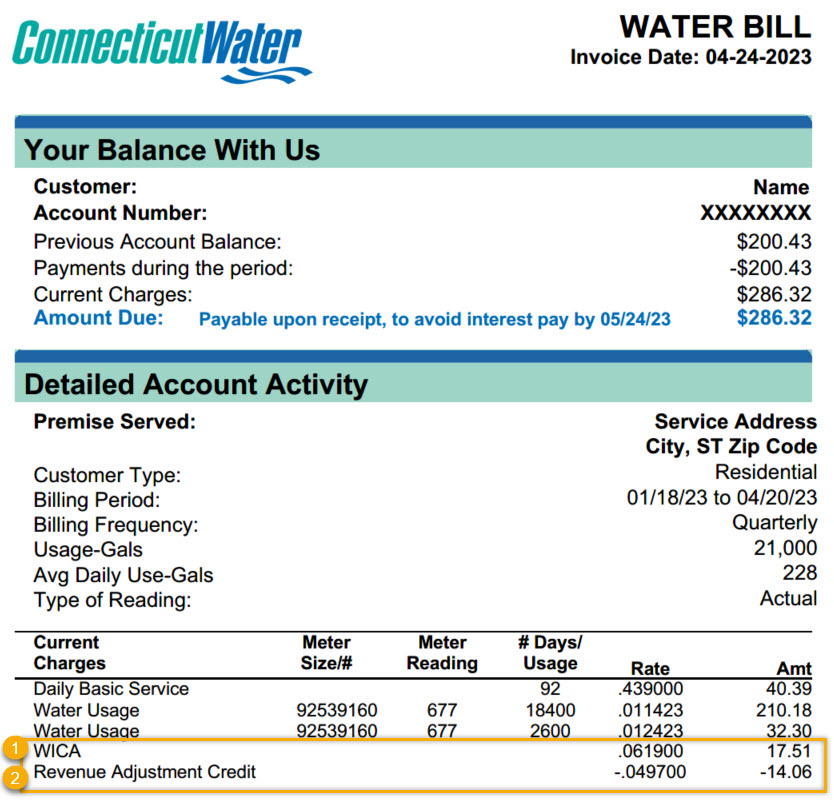

from www.ctwater.com

In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. The following utilities related to your property.

Pay your bill Connecticut Water

Are Water Bills Tax Deductible you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. you can claim a tax deduction for the portion of utilities related to your rental property or suite. The following utilities related to your property.

From askus.altogethergroup.com.au

How to read your water bill Altogether Group Are Water Bills Tax Deductible you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. In some cases, qualifying for enough tax deductions can bump you into. Are Water Bills Tax Deductible.

From renewableenergymovement.com

Unlock Tax Savings Are Water Filtration Systems Deductible for Homeowners? Are Water Bills Tax Deductible a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. you can claim a tax deduction for the portion of utilities related to your rental property or suite. The following utilities related to your property. In some cases, qualifying for enough tax deductions. Are Water Bills Tax Deductible.

From www.madison-in.gov

Water Bill Payment / Madison, Indiana Are Water Bills Tax Deductible you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. You can deduct expenses for telephone and utilities such as. Are Water Bills Tax Deductible.

From www.ctwater.com

Pay your bill Connecticut Water Are Water Bills Tax Deductible The following utilities related to your property. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. a tax deduction is an amount. Are Water Bills Tax Deductible.

From www.thegreenage.co.uk

Water Bills in the UK TheGreenAge Are Water Bills Tax Deductible a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water. Are Water Bills Tax Deductible.

From publicworks.baltimorecity.gov

Water Billing Resumes Bills will reflect charges for multiple months Are Water Bills Tax Deductible a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. The following utilities related to your property. You can deduct expenses for telephone and. Are Water Bills Tax Deductible.

From eservices.richmondhill.ca

How to Read Your Water Bill Are Water Bills Tax Deductible you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. you can claim a tax deduction for the portion of utilities related to your rental property or suite. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount. Are Water Bills Tax Deductible.

From home.nyc.gov

Sample Bill DEP Are Water Bills Tax Deductible you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. The following utilities related to your property. you can claim a tax deduction for the portion of utilities related to your rental property or suite. a tax deduction is an amount of money the canada revenue agency (cra). Are Water Bills Tax Deductible.

From pwwd.org

Understanding Your Bill Port Washington Water District Are Water Bills Tax Deductible you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce. Are Water Bills Tax Deductible.

From www.cityofnapa.org

Water Bills Napa, CA Are Water Bills Tax Deductible you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. you can deduct expenses for telephone and utilities, such. Are Water Bills Tax Deductible.

From www.hattiesburgms.com

2021 Water Bill Transition City of Hattiesburg Are Water Bills Tax Deductible In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. you can deduct expenses for telephone and. Are Water Bills Tax Deductible.

From timesproperty.com

Pay MIDC Water Bill Online A Comprehensive Guide TimesProperty Are Water Bills Tax Deductible you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that. Are Water Bills Tax Deductible.

From durhamhouse.com.au

How Much is The Average Water Bill in Melbourne? Are Water Bills Tax Deductible a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income to calculate your taxable income. you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water. Are Water Bills Tax Deductible.

From www.murrayriver.nsw.gov.au

How to read your water bill Murray River Council Are Water Bills Tax Deductible In some cases, qualifying for enough tax deductions can bump you into a lower tax bracket, which can reduce the amount of taxes you pay for the year. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. you can claim a tax deduction for the portion. Are Water Bills Tax Deductible.

From www.yourscvwater.com

How to Read Your Bill Santa Clarita Valley Water Are Water Bills Tax Deductible you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. you can claim a tax deduction for the portion of utilities related to your rental property or suite. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your. Are Water Bills Tax Deductible.

From www.scbwa.org

2019 SCBWA Water Rates and Bills State College Borough Water Authority Are Water Bills Tax Deductible you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for telephone and utilities, such as gas, oil, electricity, water and cable, if you incurred. a tax deduction is an amount of money the canada revenue agency (cra) lets you subtract from your total income. Are Water Bills Tax Deductible.

From www.lansingstatejournal.com

How to read your water bill Are Water Bills Tax Deductible The following utilities related to your property. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. you can claim a tax deduction for the portion of utilities related to your rental property or suite. you can deduct expenses for telephone and utilities, such as gas,. Are Water Bills Tax Deductible.

From waterwedoing.website

A year of water bills Are Water Bills Tax Deductible You can deduct expenses for telephone and utilities such as gas, oil, electricity, water and cable, if you incurred the expenses to earn income. you can deduct expenses for utilities, such as gas, oil, electricity, water and cable, if your rental arrangement specifies that you. In some cases, qualifying for enough tax deductions can bump you into a lower. Are Water Bills Tax Deductible.